When it comes to managing the affairs of someone who is unable to make decisions for themselves due to various reasons, legal mechanisms like conservatorship and power of attorney come into play. These two concepts serve critical roles in safeguarding the interests of individuals who require assistance in handling their financial, personal, and medical matters. In this comprehensive guide, we will delve into the nuances of conservatorship vs power of attorney.

Conservatorship vs Power of Attorney: Quick Overview

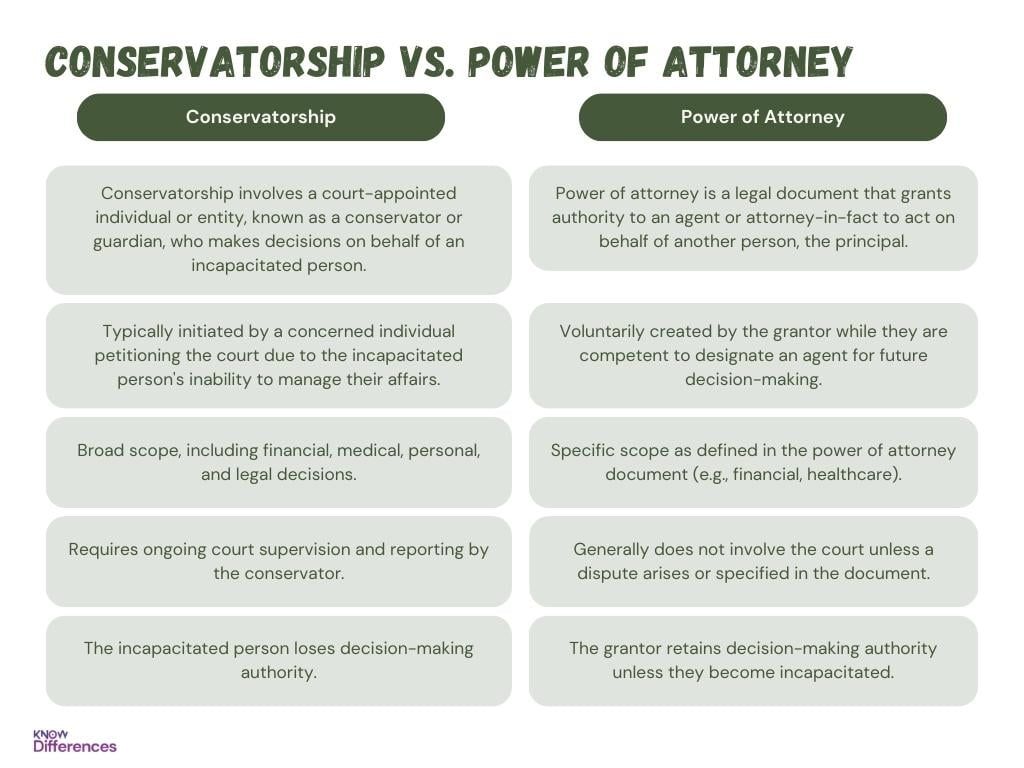

Conservatorship involves court-appointed management of an incapacitated person’s affairs, while Power of Attorney is a voluntary legal document that grants authority to an agent chosen by the grantor to act on their behalf in specific matters.

Here’s a comparison table outlining the key differences between Conservatorship and Power of Attorney:

| Aspect | Conservatorship | Power of Attorney |

|---|---|---|

| Definition | Conservatorship involves a court-appointed individual or entity, known as a conservator or guardian, who makes decisions on behalf of an incapacitated person, | Power of attorney is a legal document that grants authority to an agent or attorney-in-fact to act on behalf of another person, the principal. |

| Initiation | Typically initiated by a concerned individual petitioning the court due to the incapacitated person’s inability to manage their affairs. | Voluntarily created by the grantor while they are competent to designate an agent for future decision-making. |

| Decision-making scope | Broad scope, including financial, medical, personal, and legal decisions. | Specific scope as defined in the power of attorney document (e.g., financial, healthcare). |

| Court involvement | Requires ongoing court supervision and reporting by the conservator. | Generally does not involve the court unless a dispute arises or specified in the document. |

| Incapacity determination | Determined by the court based on medical and psychological evaluations. | Not applicable; assumes the grantor’s prior capacity to make decisions. |

| Grantor’s involvement | The incapacitated person loses decision-making authority. | The grantor retains decision-making authority unless they become incapacitated. |

| Revocation | Requires court approval for revocation, which can be a complex process. | Can be revoked by the grantor at any time as long as they are mentally competent. |

| Duration | Can be indefinite or until the incapacitated person regains capacity or passes away. | Can have a specific duration or end upon the grantor’s incapacitation or revocation. |

| Flexibility | Limited flexibility due to court oversight and regulations. | More flexible, can be tailored to the grantor’s specific needs and preferences. |

| Cost | Generally more expensive due to court fees, legal proceedings, and ongoing supervision. | Relatively less expensive as it doesn’t involve court proceedings in most cases. |

| Privacy | Less private due to court proceedings and records. | More private as long as the grantor’s wishes are followed without court involvement. |

What is Conservatorship?

A conservatorship, also known as guardianship in some jurisdictions, is a legal arrangement where a court appoints a responsible individual or entity to manage the affairs of an incapacitated person, referred to as the conservatee. This arrangement is often sought when the conservatee is unable to make sound decisions due to mental or physical limitations.

Types of Conservatorship

There are different types of conservatorship, each tailored to address specific needs and circumstances. Here are the main types of conservatorship:

- Conservatorship of the Person: In this type of conservatorship, the appointed conservator is responsible for making personal care decisions on behalf of the conservatee. This can include decisions related to healthcare, living arrangements, and daily activities.

- Conservatorship of the Estate: A conservatorship of the estate grants the conservator authority to manage the financial matters of the conservatee. This includes handling assets, paying bills, managing investments, and making financial decisions.

- Limited Conservatorship: Limited conservatorship is designed for individuals with developmental disabilities who require assistance in certain areas of their lives but can still make some decisions independently. The conservator’s authority is restricted to specific matters, allowing the conservatee to maintain a level of autonomy.

- LPS Conservatorship (Lanterman-Petris-Short Act): This type of conservatorship is specific to individuals with serious mental health conditions who require involuntary treatment and placement in a mental health facility. LPS conservatorship is often used when the person is unable to provide for their basic needs due to their mental health condition.

- Temporary Conservatorship: Temporary conservatorship is granted for a specific duration, usually to address urgent situations. It might be sought when there is an immediate need to protect the conservatee’s interests, and a permanent conservatorship is being considered.

- Emergency Conservatorship: Emergency conservatorship is granted in situations where there is an imminent risk to the conservatee’s health, safety, or financial well-being. It allows for immediate intervention to protect the conservatee.

- Testamentary Conservatorship: This type of conservatorship is established through the conservatee’s will, indicating who they want to manage their affairs in the event they become incapacitated. The court then validates the appointment.

- Voluntary Conservatorship: In rare cases, a person may voluntarily seek conservatorship to ensure their own well-being when they are unable to make decisions. This can be initiated if the individual recognizes their incapacity and wants assistance.

- Co-Conservatorship: Co-conservatorship involves appointing more than one person or entity as conservators. They can either share responsibilities or be designated to handle specific aspects of the conservatee’s life.

- Professional Conservatorship: In situations where there are complex financial matters or conflicts among family members, a professional conservator, often an attorney or an agency, may be appointed to manage the conservatee’s affairs.

Note that the specifics of conservatorship types can vary based on state laws and regulations. Deciding on the appropriate type of conservatorship involves considering the conservatee’s needs, their level of capacity, and the best way to protect their interests while respecting their autonomy. Legal advice and guidance are crucial when navigating the complexities of conservatorship.

Key Responsibilities of a Conservator

- Financial Management: A conservator takes charge of the conservatee’s financial matters, including paying bills, managing investments, and making financial decisions on their behalf.

- Personal Care Decisions: Conservators are responsible for the conservatee’s personal well-being, such as deciding on medical treatments, housing arrangements, and other day-to-day aspects.

- Reporting to the Court: Regular reporting to the court is essential, where conservators provide updates on the conservatee’s status and the management of their affairs.

What is Power of Attorney?

A power of attorney (POA) is a legal document that grants a designated person, known as the agent or attorney-in-fact, the authority to act on behalf of another individual, referred to as the principal. A power of attorney is an alternative to conservatorship. This arrangement can be tailored to specific needs and can encompass a range of decisions.

Types of Power of Attorney

Power of attorney (POA) is a legal tool that grants someone the authority to act on another person’s behalf. Depending on the scope and purpose of the authority granted, there are different types of power of attorney. Each type serves specific functions and can be tailored to meet individual needs. Here are the main types of power of attorney:

- General Power of Attorney (GPOA): A general power of attorney grants broad authority to the agent (the person appointed) to handle various financial and legal matters on behalf of the principal (the person granting the power). This can include managing bank accounts, signing contracts, paying bills, and conducting real estate transactions. However, the authority of a GPOA usually terminates if the principal becomes incapacitated.

- Limited (Specific) Power of Attorney: In this type of POA, the agent’s authority is limited to specific tasks or decisions outlined in the document. For example, a principal might grant a limited POA to sell a property or make healthcare decisions during a specified period when they are unable to do so themselves.

- Durable Power of Attorney (DPOA): A durable power of attorney remains in effect even if the principal becomes mentally or physically incapacitated. This type of POA is valuable for individuals who want to ensure that their affairs are managed by a trusted agent if they become unable to make decisions for themselves.

- Springing Power of Attorney: Unlike a durable POA, a springing POA only comes into effect when a specific triggering event occurs, such as the principal’s incapacitation. It provides a safeguard to ensure that the agent’s authority is activated only when needed.

- Medical Power of Attorney (Healthcare Proxy): This type of POA specifically focuses on healthcare decisions. The agent, also known as a healthcare proxy, is authorized to make medical treatment decisions on behalf of the principal when they are unable to communicate their wishes.

- Financial Power of Attorney: A financial power of attorney grants the agent authority to manage the principal’s financial affairs, including banking, investments, taxes, and business transactions. This can be particularly helpful in situations where the principal is traveling or is physically unable to manage these matters.

- Special Power of Attorney (SPA): A special power of attorney is similar to a limited POA but is used for specific situations or events. For instance, someone might grant a special POA to authorize another person to handle a real estate closing on their behalf.

- Non-Durable Power of Attorney: Unlike a durable POA, a non-durable POA ceases to be effective if the principal becomes incapacitated. It is often used for short-term transactions or when the principal only needs assistance temporarily.

- Co-Agents or Co-Attorneys-in-Fact: In some cases, a principal might appoint multiple agents to act together or independently. They can either work collaboratively or make decisions separately, depending on the principal’s preferences and the terms of the document.

- Revocable Power of Attorney: A revocable power of attorney allows the principal to revoke or cancel the authority granted to the agent at any time, as long as they are mentally competent to do so.

Always choose the appropriate type of power of attorney based on your specific needs and circumstances. Consulting with legal professionals can help ensure that the document accurately reflects your wishes and provides the necessary authority to your chosen agent.

Key Differences Between Conservatorship and Power of Attorney

Conservatorship and power of attorney are legal arrangements designed to address the needs of individuals who are unable to make decisions for themselves. While they share the goal of safeguarding the interests of those who require assistance, there are significant differences between these two concepts. Here are the key distinctions:

Definition and Purpose

Conservatorship involves a court-appointed individual or entity, known as a conservator or guardian, who makes decisions on behalf of an incapacitated person, the conservatee. It is typically sought when the conservatee is unable to manage their personal and financial affairs due to mental or physical limitations.

Power of attorney is a legal document that grants authority to an agent or attorney-in-fact to act on behalf of another person, the principal. This arrangement can be established for various purposes and can be customized to grant specific decision-making powers.

Initiation

Conservatorship is initiated by a petition to the court, usually filed by a concerned family member or interested party. The court then evaluates the conservatee’s capacity and determines if conservatorship is necessary. On the other hand, the principal initiates a power of attorney by creating and signing the document while they are still of sound mind. It does not require court involvement unless there are disputes or legal challenges.

Decision-Making Authority

In conservatorship, the conservator has broad decision-making authority over the conservatee’s personal care and financial matters. They are subject to court oversight and must obtain court approval for certain major decisions.

While, in power of attorney, the agent’s authority is defined by the terms of the power of attorney document and can vary based on the principal’s preferences. The principal can grant specific decision-making powers and can choose whether the agent’s authority remains active if they become incapacitated.

Oversight

Conservatorship is subject to ongoing court supervision. Conservators are required to submit regular reports to the court, ensuring transparency and accountability. While some jurisdictions might require periodic reporting, power of attorney arrangements generally involve less court oversight, especially if the principal remains competent.

Duration

Conservatorship can last indefinitely and may require periodic court reviews to determine if it is still necessary. On the other hand, the duration of a power of attorney can be specified in the document. Some are designed to be durable, remaining effective even if the principal becomes incapacitated, while others are meant for specific time frames or purposes.

Revocability

Conservatorship cannot be easily revoked by the conservatee. Termination or modification usually requires court intervention. While the principal can revoke a power of attorney at any time as long as they are mentally competent. Revocation typically involves notifying all relevant parties in writing.

Autonomy and Independence

In Conservatorship, conservatees may experience a significant loss of autonomy and independence, as their decisions are made by the conservator. While, in power of attorney, depending on the scope of authority granted, principals can maintain a greater level of independence and control over their affairs.

Understanding these key differences between conservatorship and power of attorney is crucial when considering the appropriate legal mechanism for managing the affairs of an individual who needs assistance.

What Are the Alternatives to Conservatorship?

There are other ways to support and help individuals without resorting to full conservatorship. Here are a few alternatives other than Power of Attorney:

- Advance Healthcare Directive: This is specifically for healthcare decisions. You can lay out your preferences for medical treatment in case you can’t express your wishes yourself. It designates a person (healthcare proxy or agent) to make decisions based on your wishes and values. This way, your voice is heard even if you’re unable to speak.

- Living Trusts: A living trust is like a container you create to hold your assets. You transfer ownership of your property to this trust, and you can be the trustee in charge of it while you’re capable. If you become incapacitated, a successor trustee you’ve chosen can step in to manage your affairs as laid out in the trust.

- Supported Decision-Making Agreement: This is a less formal approach where you make an agreement with someone you trust to help you understand information and make decisions. They don’t take over decision-making power; instead, they help you gather information and weigh options.

- Limited Guardianship: This is similar to conservatorship, but it’s more tailored. Instead of giving the guardian complete control, the court can assign specific responsibilities. For example, if someone is struggling with managing their finances but can handle their personal care, a limited guardianship might be appropriate.

These alternatives aim to strike a balance between ensuring an individual’s well-being and autonomy. Each option caters to different needs, and the choice depends on the person’s situation and preferences.

Conclusion

In conclusion, understanding the distinctions between conservatorship and power of attorney is essential for making informed decisions regarding the care and decision-making for individuals who may be unable to manage their own affairs. Conservatorship involves a court-appointed guardian overseeing both personal and financial matters, while power of attorney empowers a chosen agent to act on behalf of the principal based on a voluntary grant of authority. Both mechanisms serve crucial roles in safeguarding the well-being and interests of individuals in need of assistance.