Welcome to this comprehensive article where we will unravel the key differences between cost sheets and production accounts, providing you with a deeper understanding of their distinct roles in the financial landscape of production. Whether you’re a business owner, accountant, or simply curious about how costs are managed in production processes, this article will provide valuable insights in an easy-to-understand manner.

Table of Contents

What is Cost Sheet?

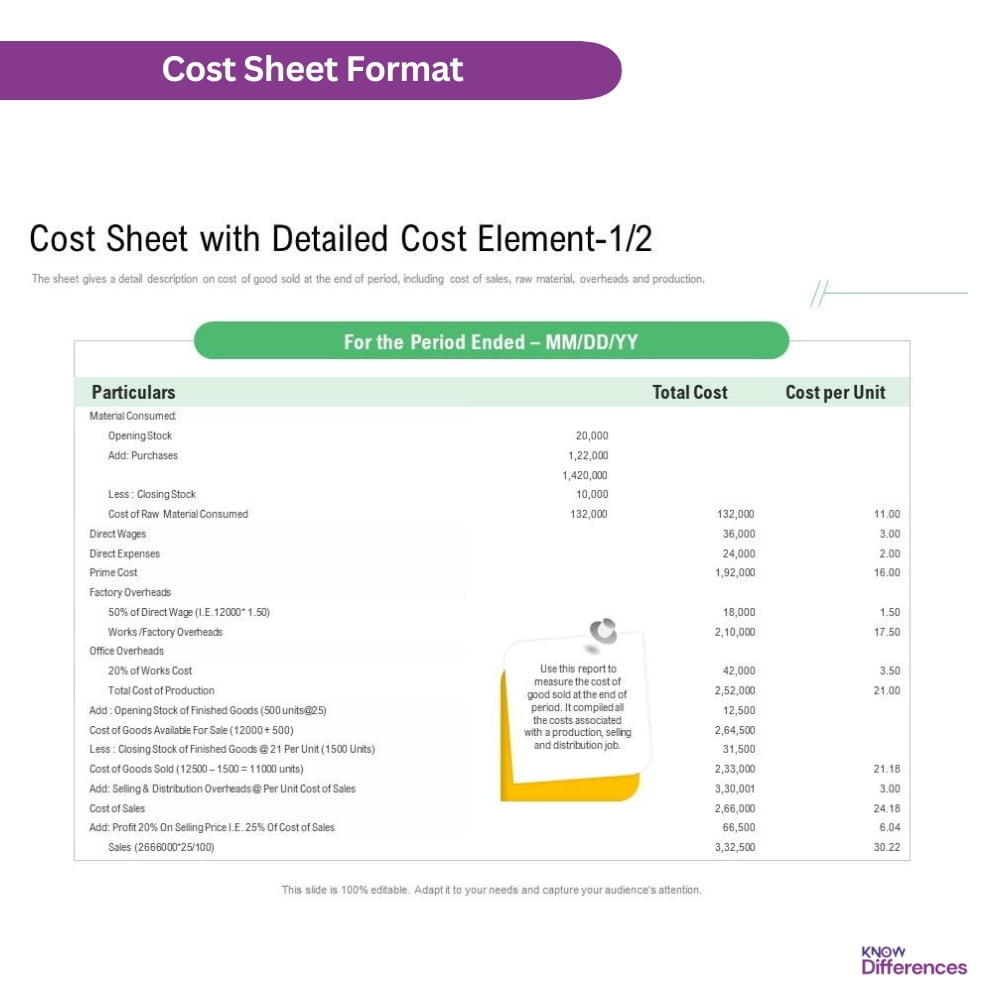

A cost sheet is a financial document that provides a detailed summary of various costs associated with the production or manufacturing of goods or services within an organization. It aims to capture all the direct and indirect costs incurred during the production process, enabling businesses to analyze and evaluate the overall cost structure of their operations. The cost sheet serves as a valuable tool for cost control, decision-making, and profitability analysis.

Key Components of Cost Sheet

A cost sheet comprises several key components that are crucial for understanding the cost structure of a business. These components may include:

- Direct Materials: The cost of raw materials or components directly used in the production process.

- Direct Labor: The wages or salaries paid to workers directly involved in the production process.

- Manufacturing Overheads: Indirect costs associated with production, such as factory rent, utilities, and depreciation of machinery.

- Other Costs: Miscellaneous costs that are not included in the above categories, such as packaging expenses, transportation costs, or administrative overheads.

What is Production Account?

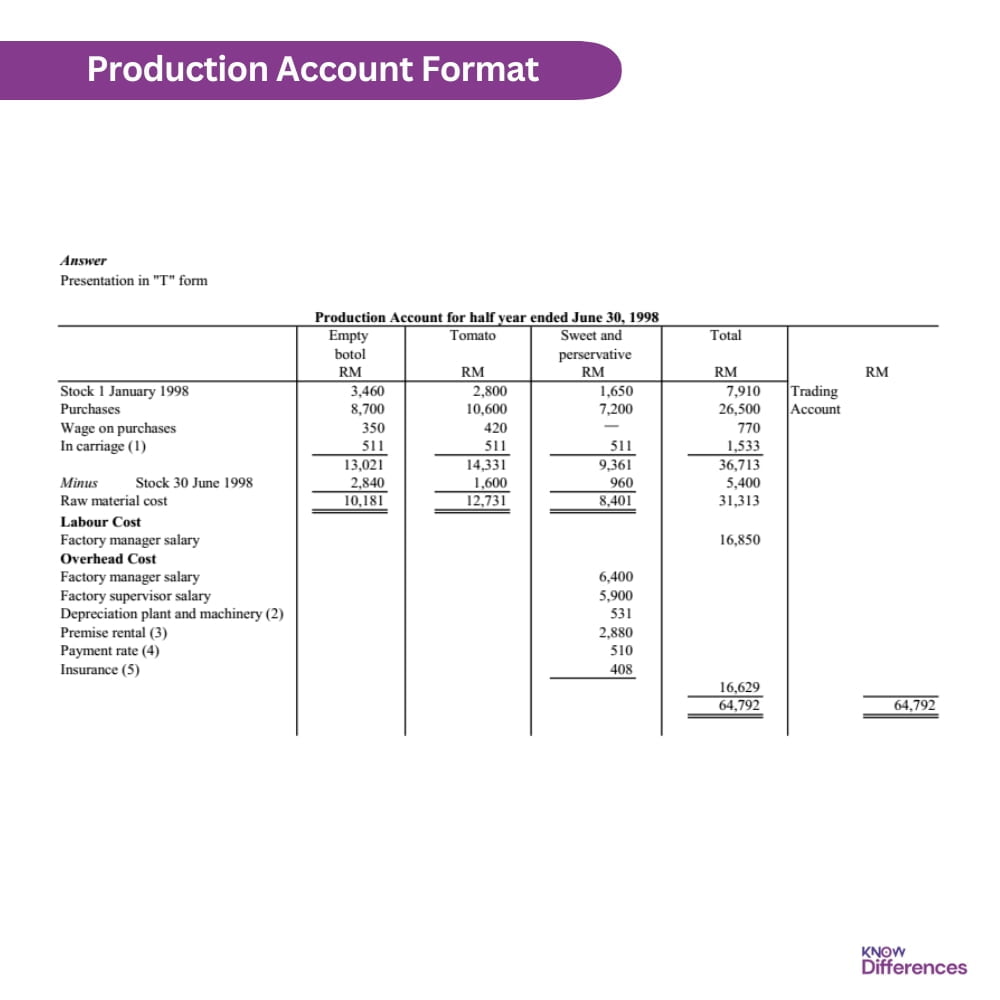

A production account is a financial statement that outlines the cost of production and the resulting value of the goods produced during a specific period. It reflects the cost of raw materials, labor, and other expenses directly involved in the production process. The production account is primarily utilized in industries that involve manufacturing, where the conversion of raw materials into finished products takes place.

Key Components of Production Account

In contrast, a production account focuses on specific components related to the production process. The key components typically found in a production account are:

- Opening Stock of Raw Materials: The value of raw materials available at the beginning of the accounting period.

- Purchases: The cost of additional raw materials purchased during the accounting period.

- Direct Expenses: Additional costs incurred directly on the production process, apart from direct materials and labor.

- Closing Stock of Raw Materials: The value of raw materials remaining at the end of the accounting period.

- Cost of Goods Manufactured: The total cost incurred in the production process, including direct materials, labor, and expenses.

- Cost of Goods Sold: The cost of goods sold during the accounting period.

Cost Sheet vs Production Account: Quick Overview

Here’s a table highlighting the possible differences between a Cost Sheet and a Production Account:

| Aspect | Cost Sheet | Production Account |

|---|---|---|

| Purpose | Provides a detailed breakdown of costs incurred in the production process | Records the production-related transactions and financial information |

| Focus | Emphasizes cost analysis and control | Primarily focuses on recording production-related data |

| Content | Includes direct and indirect costs, such as raw materials, labor, overheads, and other expenses | Contains information about production quantities, units produced, production costs, and work-in-progress |

| Timeframe | Prepared for a specific period, such as a month, quarter, or year | Usually maintained continuously throughout the production process |

| Preparation Timing | Prepared before production to estimate costs and plan budgets | Updated during and after production to record actual production costs |

| Usage | Used for cost control, budgeting, and decision-making purposes | Used for tracking production progress and analyzing production costs |

| Cost Allocation | Allocates costs to different cost centers or production activities | Focuses on allocating costs to specific products or production units |

| Cost Elements | Breaks down costs into various elements, such as direct materials, direct labor, manufacturing overheads, and other expenses | May not provide a detailed breakdown of cost elements, focusing more on overall production costs |

| Overhead Allocation | Includes allocation of overhead costs based on predetermined rates or allocation methods | May not explicitly allocate overhead costs but includes them as part of the overall production costs |

| Format | Can vary based on the organization’s requirements, but typically includes cost categories, cost centers, and cost elements | Can vary based on the organization’s accounting system, but typically includes production quantities, costs per unit, and total production costs |

| Financial Impact | Reflects the financial impact of production costs on the organization’s profitability and cost control | Reflects the production-related financial data, which may not directly impact profitability |

| Integration | Can be integrated with the organization’s financial accounting system for comprehensive cost analysis and reporting | May be integrated with other production-related systems or modules, such as inventory management or work-in-progress tracking |

Key Differences between Cost Sheet and Production Account

Here are the Key differences between Cost Sheet and Production Account with little bit explanation:

Purpose and Focus

The purpose of a cost sheet is to offer detailed insights into the costs incurred during production. It serves as a tool for cost control, budgeting, and decision-making. On the other hand, a production account’s primary focus lies in recording and tracking production-related data, such as production quantities, units produced, work-in-progress, and associated costs. While cost sheets emphasize cost analysis, production accounts concentrate more on monitoring and evaluating the production progress.

Related: Difference Between Bin Cards and Store Ledgers

Content and Elements

When it comes to content, cost sheets break down costs into various elements. These may include direct materials, direct labor, manufacturing overheads, and other expenses. The aim is to provide a granular view of the cost components involved in production. However, Production accounts may not offer a detailed breakdown of cost elements. They focus more on the overall production costs, including direct and indirect costs, without delving into specific elements.

Timeframe and Preparation Timing

Cost sheets are typically prepared for specific periods, such as a month, quarter, or year. They allow businesses to analyze costs and plan budgets accordingly. In contrast, production accounts are maintained continuously throughout the production process. They are updated during and after production, allowing for the recording of actual production costs and facilitating comparisons between planned and actual costs.

Usage and Financial Impact

Cost sheets play a vital role in cost control and decision-making. They provide insights into the financial impact of production costs on the organization’s profitability. By analyzing cost variances and trends, businesses can identify areas for improvement and make informed decisions to optimize their production processes. Production accounts, while not directly impacting profitability, provide essential data for monitoring production progress, tracking costs, and evaluating efficiency.

Cost Allocation and Overhead

Cost sheets often involve the allocation of costs to different cost centers or production activities. This process ensures that costs are accurately attributed to specific areas of the production process. It may include allocating overhead costs based on predetermined rates or allocation methods. While Production accounts may not explicitly allocate overhead costs. Instead, they incorporate these costs as part of the overall production costs without a detailed breakdown.

Format and Integration

Cost sheets can vary in format based on the organization’s requirements. They typically include cost categories, cost centers, and cost elements. These sheets can be integrated with the organization’s financial accounting system, allowing for comprehensive cost analysis and reporting. On the other hand, production accounts may have different formats depending on the organization’s accounting practices. They focus on capturing production quantities, costs per unit, and total production costs. Integration of production accounts may involve linking them with other production-related systems or modules, such as inventory management or work-in-progress tracking.

Use Cases

Cost sheets and production accounts find applications in different scenarios within an organization. Cost sheets are widely used by businesses to analyze product costs, determine pricing strategies, and make informed decisions about resource allocation. They also aid in assessing the profitability of different product lines and evaluating the impact of cost variations on the overall production process.

Production accounts are predominantly used in manufacturing industries to monitor production costs, evaluate production efficiency, and determine the valuation of finished goods. They play a vital role in inventory management, enabling businesses to keep track of the cost of goods sold and manage their stock levels effectively.

Limitations

While cost sheets and production accounts are valuable financial tools, they do have their limitations. Cost sheets rely on accurate and up-to-date data inputs to provide meaningful insights. Inaccurate data or estimates can lead to flawed cost calculations, affecting decision-making processes. Additionally, cost sheets may not capture all the hidden costs associated with the production process, such as quality control expenses or costs related to product defects.

Similarly, production accounts are subject to limitations. They mainly focus on cost aspects and may not provide a comprehensive analysis of the production process. Other performance indicators, such as productivity or efficiency measures, may be required to obtain a holistic view of the manufacturing operations.

Conclusion

In conclusion, understanding the difference between cost sheets and production accounts is essential for effective financial management in the production realm. Cost sheets enable businesses to analyze and control costs by breaking them down into various elements. On the other hand, production accounts focus on recording production-related transactions and monitoring the progress of production. By leveraging these financial tools strategically, businesses can gain valuable insights, make informed decisions, and optimize their production processes for enhanced efficiency and profitability.

Frequently Asked Questions (FAQs)

What is the main difference between a cost sheet and a production account?

A cost sheet focuses on analyzing and breaking down the costs incurred in the production process, providing a detailed view of cost components. On the other hand, a production account primarily records production-related transactions and tracks production progress, offering a comprehensive overview of the financial aspects of production.

What is the purpose of a cost sheet and a production account?

The purpose of a cost sheet is to facilitate cost analysis, control, budgeting, and decision-making by providing insights into production costs. While a production account serves to monitor production progress, analyze production costs, and evaluate efficiency.

What elements are included in a cost sheet and a production account?

A cost sheet includes various cost elements, such as direct materials, direct labor, manufacturing overheads, and other expenses, providing a breakdown of cost components. In contrast, a production account focuses more on overall production costs, including direct and indirect costs, without a detailed element breakdown.

How do cost sheets and production accounts impact decision-making and financial analysis?

Cost sheets provide valuable insights into the financial impact of production costs on profitability, enabling businesses to identify cost variances, trends, and areas for improvement. Production accounts, while not directly impacting profitability, offer crucial data for monitoring production progress, tracking costs, and evaluating production efficiency